Should I Focus on My Income or Cutting Back on Expenses?

Should I focus on increasing my income or cutting down on everyday expenses? If you value your time or have an eager interest in how to become financially sound like I do, then you should probably have noticed that most of the money advice we hear out there, whips us up to focus on pinching pennies rather than increasing our income.

Should we trust the gurus? Many of them are authors of popular personal finance books, or maybe we should listen to the guy that sounds smart on TV right? Well, think again, you might want to reevaluate your choices... At the end of the day, there's only so much you can cut.

Should I focus on Increasing my Income or spending less

What's the best choice?

Let's say that you're finally committed to getting your financials sorted out, so you might be thinking, what's the next step, what should I do now? Should I focus on increasing my income or should I try to cut down my expenses?

When we try to find solutions to this question, something that immediately pops up in our minds is that there's always something we would spend on that we don't really need. Maybe it is the expensive gym membership or that magazine subscription or those old incandescent light bulbs that we still have in our house.

If you dive into the personal finance space, you'd find that 90% of the dilemmas are about discussions on topics such as investing alternatives, budgeting, and paying off debt, besides, most of them don't even mention creating the right skill set to make more money or increase our income.

So why is focusing on spending less so crucial?

Focusing on Cutting Expenses

How is buying that Starbucks coffee so harmful to my financials or getting that Netflix subscription? The answer is that everything over time adds up.

Have you heard of compound interest? A tool regarded as one of the most powerful tools in finance? It's a double-edged sword. Yes, that 14 USD a week we spend on coffee at a restaurant or a convenience store, in a year becomes 728 USD, and if we keep up with this consumption over time, it could be something you might regret later on.

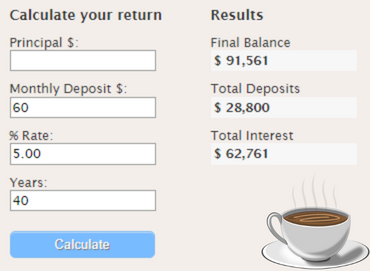

If you were to invest those 728 USD yearly at a considerable rate of 5%, instead of blowing it over coffee every year, in 40 years you would come out with $91,561!

60USD/month spent on coffee - Return Calc.

60USD/month spent on coffee - Return Chart

Considering a small expenditure such as a coffee could have a significantly high opportunity cost, we may be prompted to rethink every little choice we make every day about our expenditures.

Budgeting can be hard, right? That's why we're committed to bringing you the best tools to fight this arduous battle. We've prepared for you a simple and easy-to-follow course that will make you break those bad spending habits!

Some of us might not be comfortable breaking that habit, perhaps that coffee every day is something that we truly enjoy, and otherwise, we'd feel miserable. In those types of situations is when increasing your income comes into play.

Focusing on Increasing Income

No matter how many discount codes and coupons you use or how many times you eat at home or how many unused electrical devices you unplug, the amount of money you can save is limited by how much money you are earning.

Instead of trying to cut out that delicious coffee you like to drink in the morning, why not find a way to make more money so that you can compensate for your coffee and extra expenditures?

You can even find something fulfilling that you would like to do in your spare time, and besides giving you extra cash, you'll also feel good about yourself.

You can find ways to turn that hobby into a business or tune that skill in a way that will broaden your income streams. For instance, you can teach something you are knowledgeable in, rent out a room, take a second job, etc...Moreover, that additional money you receive gives you a lot more room to both spend and save.

Are you still wandering around? Make sure to check out our blog post on 10 Ways to Make an Extra $1,000 This Weekend

Should I Focus on Incresing My Income or Cutting Expenses

Trimming unnecesary expenses is a financially sound decision, but you should consider it as a short-term solution when you don't have a plan already to increase your income.

Creating multiple income streams is the way to go and should be your main focus as it will be easier for you to spend less and it will allow you to also increase the rate and size of your investments.

Do you agree? Share your thoughts in the comments below!